Taxes No Receipt . Web the court then laid out the cohen rule, which states that a taxpayer who has no receipts documenting business. But what happens if you don’t have a. You must have spent the money yourself. Web in order for you to be able to claim the items in “what can i claim on tax without receipts” you must meet the ato’s 3 rules: This receipt is for your retention. Web a tax deduction receipt should contain or incorporate the following: Web if possible, you should always keep your receipts for business expenses and other tax deductions. Web conditions for claiming input tax. Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: Web the ato wants you to keep a receipt for every expense you claim on your tax return.

from flicksinthegarden.com

Web a tax deduction receipt should contain or incorporate the following: Web if possible, you should always keep your receipts for business expenses and other tax deductions. You must have spent the money yourself. Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: But what happens if you don’t have a. Web the ato wants you to keep a receipt for every expense you claim on your tax return. Web conditions for claiming input tax. Web the court then laid out the cohen rule, which states that a taxpayer who has no receipts documenting business. Web in order for you to be able to claim the items in “what can i claim on tax without receipts” you must meet the ato’s 3 rules: This receipt is for your retention.

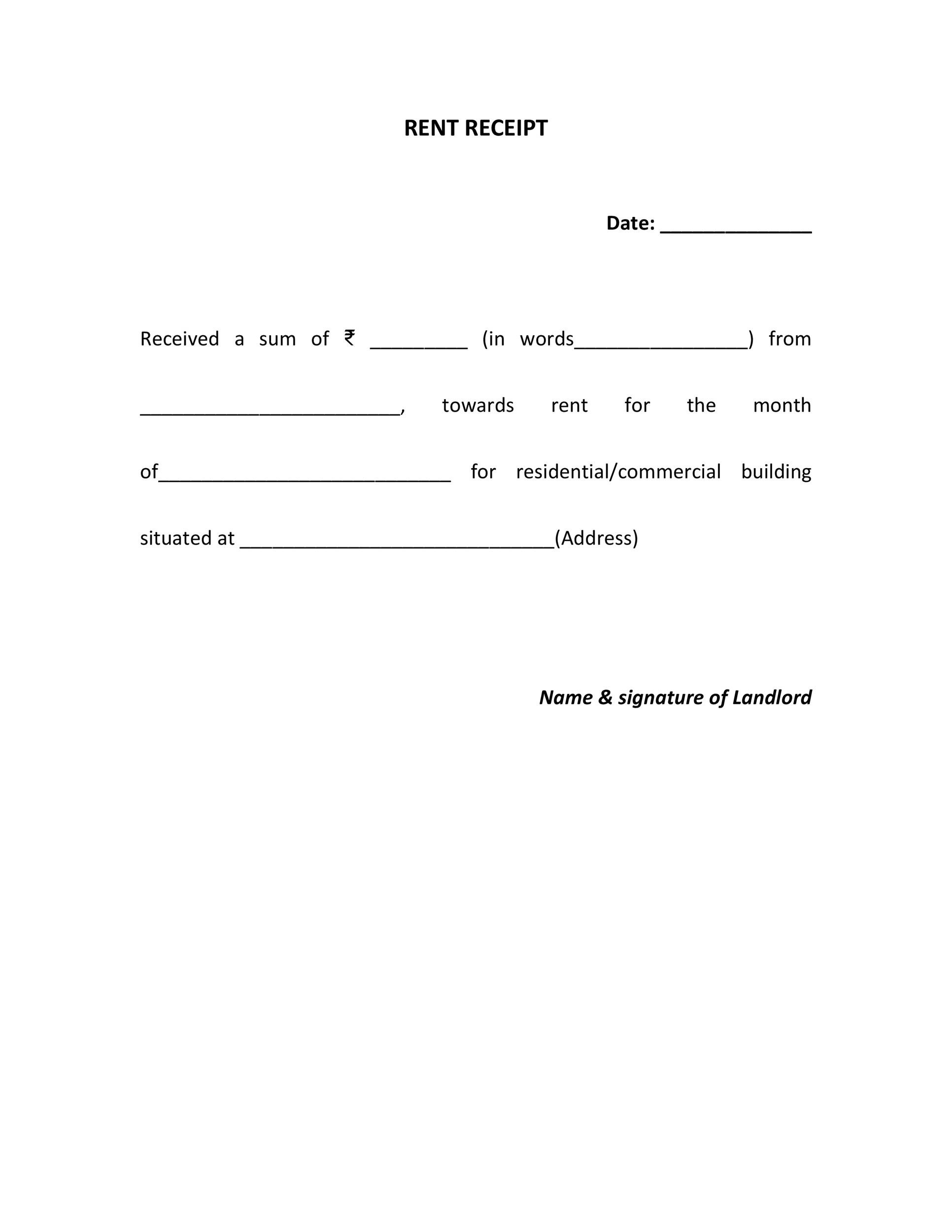

Free Receipt Template For Rent Superb Receipt Forms

Taxes No Receipt Web the ato wants you to keep a receipt for every expense you claim on your tax return. Web a tax deduction receipt should contain or incorporate the following: Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: Web conditions for claiming input tax. This receipt is for your retention. Web in order for you to be able to claim the items in “what can i claim on tax without receipts” you must meet the ato’s 3 rules: Web the ato wants you to keep a receipt for every expense you claim on your tax return. You must have spent the money yourself. But what happens if you don’t have a. Web the court then laid out the cohen rule, which states that a taxpayer who has no receipts documenting business. Web if possible, you should always keep your receipts for business expenses and other tax deductions.

From lesboucans.com

Invoice Receipt Template Word Database Taxes No Receipt Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: Web conditions for claiming input tax. But what happens if you don’t have a. This receipt is for your retention. Web if possible, you should always keep your receipts for business expenses and other tax deductions. Web in order for you to be. Taxes No Receipt.

From dipentinodesign.blogspot.com

How To Organize Receipts For Taxes dipentinodesign Taxes No Receipt Web a tax deduction receipt should contain or incorporate the following: This receipt is for your retention. Web conditions for claiming input tax. But what happens if you don’t have a. Web the court then laid out the cohen rule, which states that a taxpayer who has no receipts documenting business. Web if possible, you should always keep your receipts. Taxes No Receipt.

From ampastahhu.blogspot.com

Bir Official Receipt Sample 2020 What Is The Difference Between Sales Taxes No Receipt But what happens if you don’t have a. Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: Web a tax deduction receipt should contain or incorporate the following: Web conditions for claiming input tax. This receipt is for your retention. Web in order for you to be able to claim the items. Taxes No Receipt.

From invoicehome.com

Sales Receipt Templates Quickly Create Free Sales Receipts Taxes No Receipt But what happens if you don’t have a. Web the court then laid out the cohen rule, which states that a taxpayer who has no receipts documenting business. Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: Web in order for you to be able to claim the items in “what can. Taxes No Receipt.

From belogimannabila.blogspot.com

Receipt Sample Download Master of Template Document Taxes No Receipt Web the ato wants you to keep a receipt for every expense you claim on your tax return. This receipt is for your retention. Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: Web conditions for claiming input tax. Web in order for you to be able to claim the items in. Taxes No Receipt.

From educators.brainpop.com

Taxes Lesson Plan Economics BrainPOP Educators Taxes No Receipt But what happens if you don’t have a. Web in order for you to be able to claim the items in “what can i claim on tax without receipts” you must meet the ato’s 3 rules: Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: Web the court then laid out the. Taxes No Receipt.

From www.examples.com

Tax Receipt 8+ Examples, Format, Word, Numbers, Pages, Pdf Taxes No Receipt Web in order for you to be able to claim the items in “what can i claim on tax without receipts” you must meet the ato’s 3 rules: Web the court then laid out the cohen rule, which states that a taxpayer who has no receipts documenting business. This receipt is for your retention. Web a tax deduction receipt should. Taxes No Receipt.

From www.studocu.com

Od24c0790 oct TAX RECEIPT Application No. / Receipt No Taxes No Receipt Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: You must have spent the money yourself. Web conditions for claiming input tax. Web if possible, you should always keep your receipts for business expenses and other tax deductions. Web in order for you to be able to claim the items in “what. Taxes No Receipt.

From www.smallbiztechnology.com

10 Apps That Manage Pesky Business Receipts (And Will Save Your Sanity Taxes No Receipt Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: Web conditions for claiming input tax. Web the court then laid out the cohen rule, which states that a taxpayer who has no receipts documenting business. Web if possible, you should always keep your receipts for business expenses and other tax deductions. But. Taxes No Receipt.

From www.taxscan.in

No Tax Penalty u/s 44A and 44B if the Commission receipt falls Taxes No Receipt Web the court then laid out the cohen rule, which states that a taxpayer who has no receipts documenting business. Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: Web conditions for claiming input tax. But what happens if you don’t have a. Web if possible, you should always keep your receipts. Taxes No Receipt.

From templates.rjuuc.edu.np

Nonprofit Invoice Template Taxes No Receipt Web conditions for claiming input tax. But what happens if you don’t have a. Web if possible, you should always keep your receipts for business expenses and other tax deductions. Web the court then laid out the cohen rule, which states that a taxpayer who has no receipts documenting business. Web the ato wants you to keep a receipt for. Taxes No Receipt.

From dheelz.blogspot.com

What is a Professional Tax Receipt (PTR) and how to obtain it? Taxes No Receipt This receipt is for your retention. But what happens if you don’t have a. Web the ato wants you to keep a receipt for every expense you claim on your tax return. Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: Web in order for you to be able to claim the. Taxes No Receipt.

From www.restaurantbookkeepers.com.au

business receipts tax invoice POS Taxes No Receipt Web in order for you to be able to claim the items in “what can i claim on tax without receipts” you must meet the ato’s 3 rules: This receipt is for your retention. Web if possible, you should always keep your receipts for business expenses and other tax deductions. But what happens if you don’t have a. Web the. Taxes No Receipt.

From www.patriotsoftware.com

Receipts for Taxes Small Business Receipts to Keep Taxes No Receipt Web if possible, you should always keep your receipts for business expenses and other tax deductions. Web in order for you to be able to claim the items in “what can i claim on tax without receipts” you must meet the ato’s 3 rules: Web a tax deduction receipt should contain or incorporate the following: Web the australian taxation office. Taxes No Receipt.

From doctemplates.us

Tax Receipt For Donation Template DocTemplates Taxes No Receipt Web the australian taxation office (ato) has three golden rules when it comes to claiming tax deductions: Web a tax deduction receipt should contain or incorporate the following: Web in order for you to be able to claim the items in “what can i claim on tax without receipts” you must meet the ato’s 3 rules: You must have spent. Taxes No Receipt.

From www.patriotsoftware.com

Receipts for Taxes Small Business Receipts to Keep Taxes No Receipt Web the ato wants you to keep a receipt for every expense you claim on your tax return. Web a tax deduction receipt should contain or incorporate the following: Web the court then laid out the cohen rule, which states that a taxpayer who has no receipts documenting business. You must have spent the money yourself. But what happens if. Taxes No Receipt.

From bestlettertemplate.com

Free Blank Printable Tax Receipt Template with Example in PDF Taxes No Receipt This receipt is for your retention. Web the ato wants you to keep a receipt for every expense you claim on your tax return. Web conditions for claiming input tax. But what happens if you don’t have a. Web a tax deduction receipt should contain or incorporate the following: Web the court then laid out the cohen rule, which states. Taxes No Receipt.

From vabootcamp.ph

The Simplest Method on How to Register as a Freelancer in BIR (Updated Taxes No Receipt Web conditions for claiming input tax. Web the ato wants you to keep a receipt for every expense you claim on your tax return. Web in order for you to be able to claim the items in “what can i claim on tax without receipts” you must meet the ato’s 3 rules: But what happens if you don’t have a.. Taxes No Receipt.